Introduction :

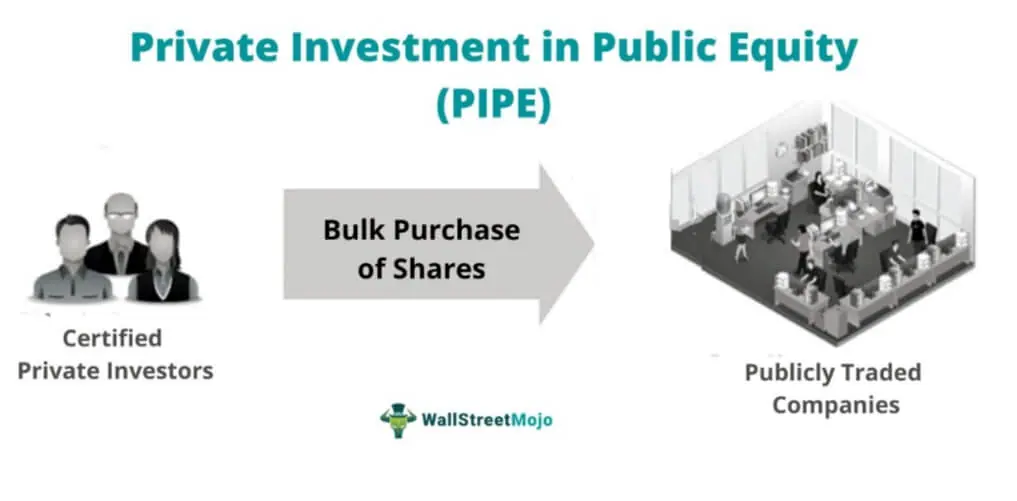

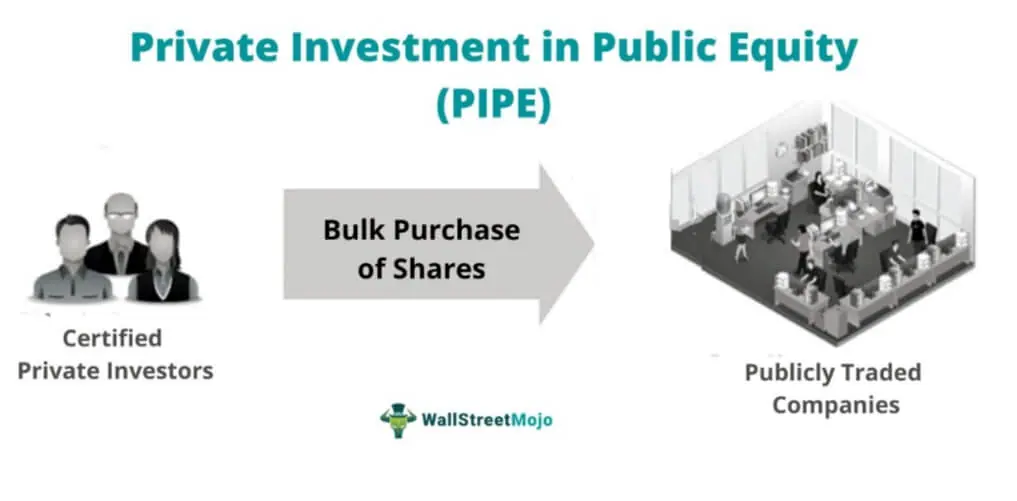

Unveiling Private Investment in Public Equity (PIPE)

Private Investment in Public Equity, commonly referred to as PIPE, is a financial transaction that has gained prominence in recent years. It plays a pivotal role in the capital markets, allowing public companies to raise funds from private investors. In this article, we will unravel the complexities of PIPE transactions, shedding light on their definitions, mechanics, and the profound implications they hold for both public corporations and private investors.

Defining PIPE :

Definition :

A Private Investment in Public Equity (PIPE) is a financing arrangement in which private investors, including institutional investors and accredited individuals, purchase shares of a public company’s stock at a predetermined price.

Mechanics :

PIPE transactions typically involve the issuance of newly created shares by the public company to the private investors. These transactions can take various forms, including equity investments, convertible securities, or preferred stock offerings.

Significance :

Private Investment in Public Equity transactions have several significant implications for both public companies and private investors.

Benefits for Public Companies :

Capital Injection : PIPE transactions provide an immediate infusion of capital to public companies, enabling them to fund growth initiatives, reduce debt, or address financial challenges.

Flexibility : PIPEs offer flexibility in structuring the deal, allowing companies to tailor the transaction to their specific needs and market conditions.

Opportunities for Private Investors :

Investment Opportunities : PIPEs provide private investors access to shares of public companies at potentially favorable terms, often at a discount to the current market price.

Portfolio Diversification : Private investors can diversify their portfolios by participating in PIPE transactions across various industries and sectors.

Considerations :

1. Regulatory Compliance :

Legal Framework : PIPE transactions are subject to regulatory requirements and compliance obligations, and understanding these is crucial for both issuers and investors.

Securities Laws : Compliance with securities laws, including disclosure and reporting requirements, is essential to avoid legal complications.

2. Due Diligence :

Risk Assessment : Conduct thorough due diligence to assess the financial health and prospects of the public company issuing the PIPE, as well as the terms of the transaction.

Investor Qualification : Private investors should ensure they meet the qualifications required for participating in PIPEs.

Conclusion :

In summary, Private Investment in Public Equity (PIPE) transactions represent a dynamic and significant aspect of the financial landscape. These transactions offer public companies a lifeline of capital, while providing private investors unique opportunities for portfolio diversification and potential returns. However, navigating the world of PIPE requires a deep understanding of regulatory compliance, due diligence, and market dynamics. Whether you are a public company considering a PIPE or a private investor seeking to participate, thorough research and professional guidance are essential. PIPE transactions continue to shape the financial industry, offering a win-win solution for both issuers and investors in today’s ever-evolving market.

Pingback: Cryptocurrency Taxation: What You Need to Know - Wise Financial Cents Blog